The neobank 86400 have increased their sign up offer for the current month to $20 for both parties.

EDIT: Bonus extended for all of October as well.

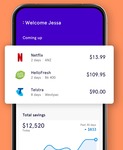

I've banked with them for the past 12 months, so here are some random thoughts:

- App is convenient, but not as detailed as Up bank

- There is no web app, but that hasn't been an issue for us.

- They have joint accounts if you ask for them which is a bonus (and currently unique among the neobanks)

- The interest rate is 1.6% but has fallen in line with the other neobanks. However you can have multiple 100k accounts where the bonus is applied.

- In order to activate the bonus interest, you only need to deposit 1k per month and that is a simple requirement to meet.

Answers to a lot of the questions in the comments can be found here:

86400 FAQs

How the referral program works:

Where do I enter the code?

- Once you've downloaded the app, make sure you enter the invite code you received on the 'About you' screen during the sign up process.

Invite codes can be found in the "Random" code generator button at the bottom of this post.

- You can add your own code by clicking 'edit' on the right side of the generator

I've signed up - what next?

- Put some money into your account by making a transfer from any other Australian bank account. You'll find your BSB and account number in the app.

- Then, go treat yo'self (i.e. make a purchase) using Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay or your 86 400 Visa Debit card by 30 September 2020.

That's it! You'll receive your $20 bonus in your Pay account within a couple of days.

T&C for current promotion below:

"The Refer a Friend offer will run from 1 April 2020 to 31 December 2020 and is available to all 86 400 customers.

The Refer a Friend offer cannot be used in conjunction with any other offer (unless we determine otherwise).

“Friends” who were previously 86 400 customers and closed their accounts within the past 12 months are not eligible for this offer.

Only settled card purchases are eligible to meet the bonus criteria. This means we must wait until the card payment has been settled (no longer showing as "pending" in the friend’s transaction history) before the referrer or the friend become eligible for the bonus payment. The card purchase and transaction settlement must occur by 31 December 2020.

Eligible customers and “friends” will each receive a payment of $10 each into their Pay account within a few days of fulfilling the bonus criteria.

September double bonus offer: “Friends” who join on or after 1 September 2020 and fulfil the bonus offer criteria by 30 September 2020 will each receive a payment of $20 into their respective Pay accounts (instead of the standard $10 bonus).

There are always a few people who will try to game the system, so here are some fair play conditions.

We retain the absolute right to refuse to pay or cancel a “refer a friend bonus” payment without notice to you. The reasons for us to refuse or cancel a payment may include, but are not limited to, if:

● we believe that your access to the 86 400 app is or may be fraudulent

● we believe that you have threatened the security of 86 400

● we believe you have breached any of our General Terms

● we believe you are acting in bad faith

● we have locked or closed your account

● your account contains unpaid charges or is overdrawn

We also retain the absolute right to stop the offer at any time and to change the conditions or incentive of the offer."

I definitely don't work for them. We have used several of the neobanks (Up, Xinja, etc) and 86400 has been decent for us.

I saw Joint accounts on their roadmap and called them up to ask about it and we were given one.

The rest of the info is from the comparison on Whirlpool:

https://docs.google.com/spreadsheets/d/145iM6uuFS9m-Rul65--e…