Macquarie have dropped the rate by 0.1% on their variable Basic and Offset owner occupier and investor home loans. Their offset home loans in particular look like a real good deal, equivalent to rates for non-offset loans at other lenders. Still requires an annual fee ($248) but even the fee is lower than average. Might have to give my current bank a ring to negotiate.

Macquarie Owner Occ rates from their website as of 11 Sept (basic and offset rates are the same; offset requires $248 fee):

| LVR | Rate |

|---|---|

| <= 60% | 2.14% |

| <= 70% | 2.19% |

| <= 80% | 2.24% |

| <= 90% | 2.69% |

Macquarie Investor rates from their website as of 11 Sept (basic and offset rates are the same; offset requires $248 fee):

| LVR | Rate |

|---|---|

| <= 60% | 2.29% |

| <= 70% | 2.39% |

| <= 80% | 2.49% |

| <= 90% | 3.25% |

Other low owner occupier variable loans for comparison (rates below are for 80% LVR):

| Loan | Rate | Link |

|---|---|---|

| Macquarie Basic | 2.24% | Macquarie |

| Macquarie Offset | 2.24% (requires $248 fee) | Macquarie |

| St George Basic | 2.29% | St George |

| UBank | 2.34% | Ubank |

| ING | 2.49% | ING |

| ING Offset | 2.54% (requires $299 fee) | ING |

Other low investor variable loans for comparison (rates below are for 80% LVR):

| Loan | Rate | Link |

|---|---|---|

| Macquarie Basic | 2.49% | Macquarie |

| Macquarie Offset | 2.49% (requires $248 fee) | Macquarie |

| UBank | 2.55% | Ubank |

| St George Basic | 2.59% | St George |

| ING | 2.64% | ING |

| ING Offset | 2.69% (requires $299 fee) | ING |

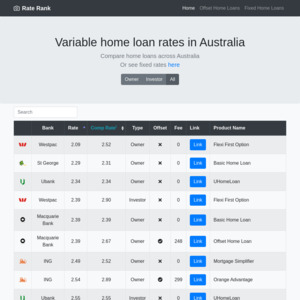

Other loans can be found on my rate tracker website: RateRank - Variable Offset | RateRank - Variable | RateRank - Fixed . Note I don't track every single bank, but most of the majors are on there. Missing most of the neobanks/online only lenders but plan to add them eventually.

St George is 1.84% p.a. 2 year fixed rate & no rate change based on LVR