Kraken is currently running a referral promotion for new users. If you sign up using a referral link and trade at least $200 AUD worth of crypto, both you and the referrer will receive $100 AUD in Bitcoin.

I recommend using Up with PayID for the $200 deposit (and ANZ may/may not work), since ING and CBA may hold the transfer for 24 hours.

After buying the A$200 BTC, I instantly received a reward notification for the A$100 BTC.

Tip 1: To pay lower fees on buying/selling, get the Kraken+ trial and then cancel it after.

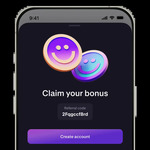

Update - Tip 2: Some users have mentioned that you need to ensure that you enter the referral code on signup, if it doesn't automatically populate. The referral code appears on the referral link. If it automatically populates, as it did for me, you don't need to bother with the code.

How it works

- Invite friends

Share your referral link to get started. - Friend joins and trades

They sign up, fund A$200 and trade A$200 within their first 30 days. - Get paid together

You both earn a A$100 bonus, paid within 14 days.

Note: Offer only valid for new accounts signed up via the Kraken mobile app.

Rewards are paid in BTC.

Key Info

- Offer is for new Kraken accounts only

- Must use a referral link when registering

- Trade must be completed within 30 days of signing up

- Bonus is paid in BTC and credited automatically

- Kraken is AUSTRAC-registered and widely used in Australia

Referral Link

Use the OzBargain referral system below this post to get a referral.

Mod: Cleaned $100 Referral system 6/10

Where us referral section?