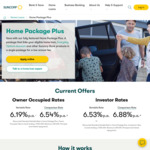

Want a packaged Home loan without the Fee?

We're delighted to announce that Suncorp are offering a 30 year annual package fee waiver/reimbursement for the life of the loan.

$375 annual package fee will be charged and reimbursed while package is active.

Savings based on 30-year loan term. ($375 * 30 = $11,250)

SAVINGS OF $11,250

*Establishment fee: $0

*Account keeping fee: $0

*Mortgage offset fee: $0

Eligibility Criteria:

NEW home loan packages.

Home Loan taken out as part of the Home Package Plus Special Offer >= $150,000 and borrowings

Manually calculated: Comparison rates when accounting for NO annual fee for the life of the loan.

Based on $150,000 over 25 year term incorporating fees and charges that are applicable for the chosen product

Owner Occupied P/I: 6.19% (CR 6.20%)

Investment P/I: 6.53% (CR 6.54%)

For a quick self assessment to see if you would qualify see below table (Note each persons household situation will vary so please only use the below as a general guide:

Block-quote Household income —-Borrowing capacity

$100,000.00 | —- $260k - $480k

$150,000.00 | —- $500k - $800k

$200,000.00 | —- $760k - $1.075Mil

$250,000.00 | —- $990k - $1.3Mil

$300,000.00 | —- $1.22Mil - $1.58Mil

$350,000.00 | —- $1.5Mil - $1.83Mil

$400,000.00 | —- $1.75Mil - $2.1Mil

Please feel free to email me at Nick@homeloanshub.com.au or text/call me on 0439 603 423 and I would be happy to answer all finance related questions.

We have also recently negotiated lower than advertised rates.

Nick Milojevic

Senior Mortgage Broker

http://homeloanshub.com.au/

Credit Representative Number 557884 / Australian Credit Licence Number 384704

wow!!!